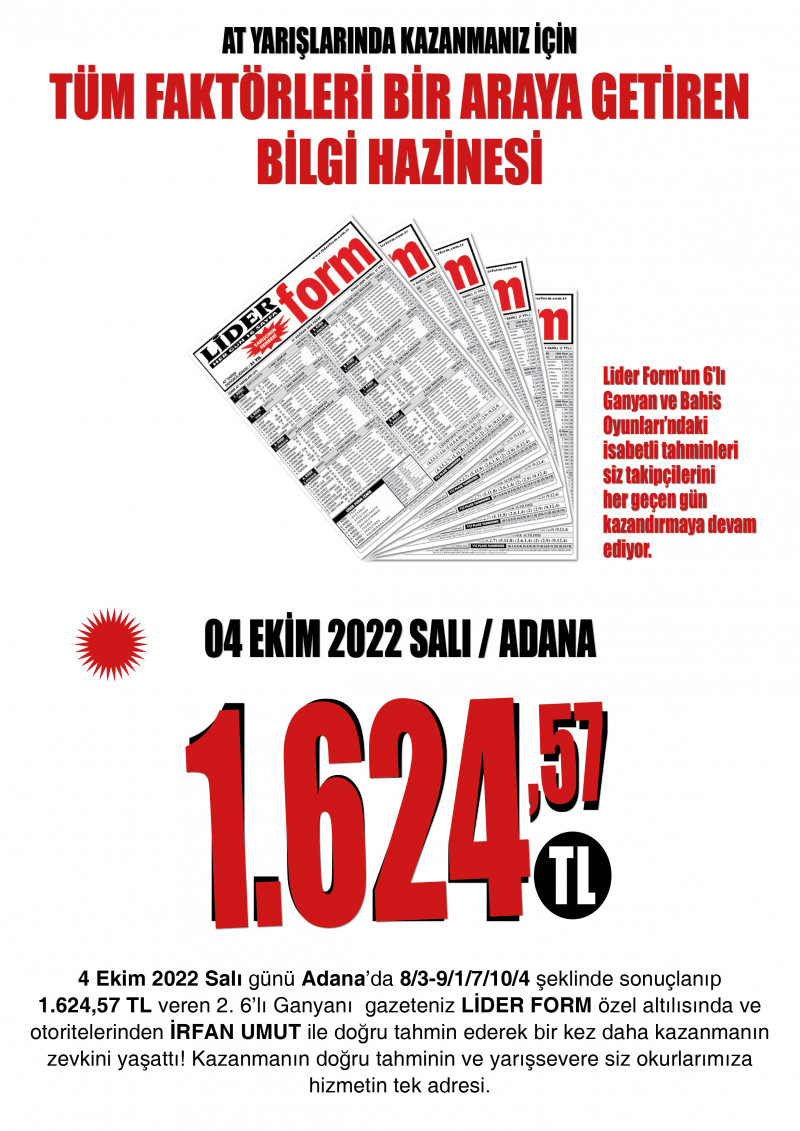

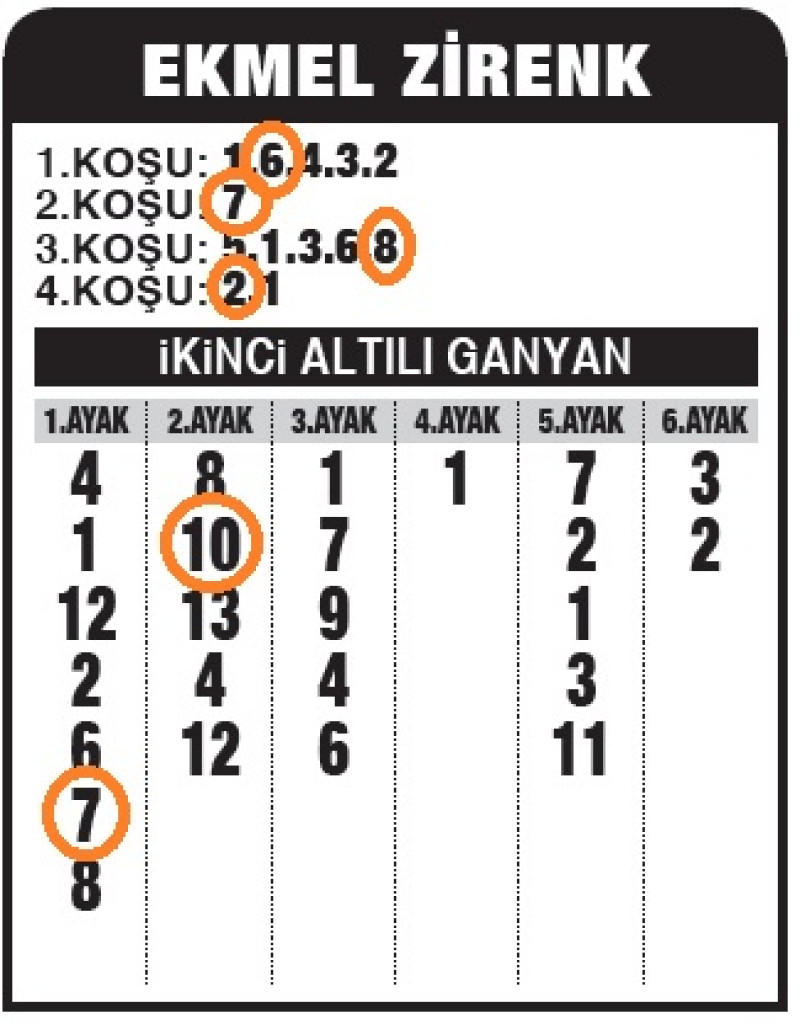

Lider Form'un 6'lı Ganyan ve Bahis Şovu devam ediyor... At Yarışı Haberleri

Get tax form (1099/1042S) Download a copy of your 1099 or 1042S tax form so you can report your Social Security income on your tax return. Your 2023 tax form will be available online on February 1, 2024. Most people get a copy in the mail.

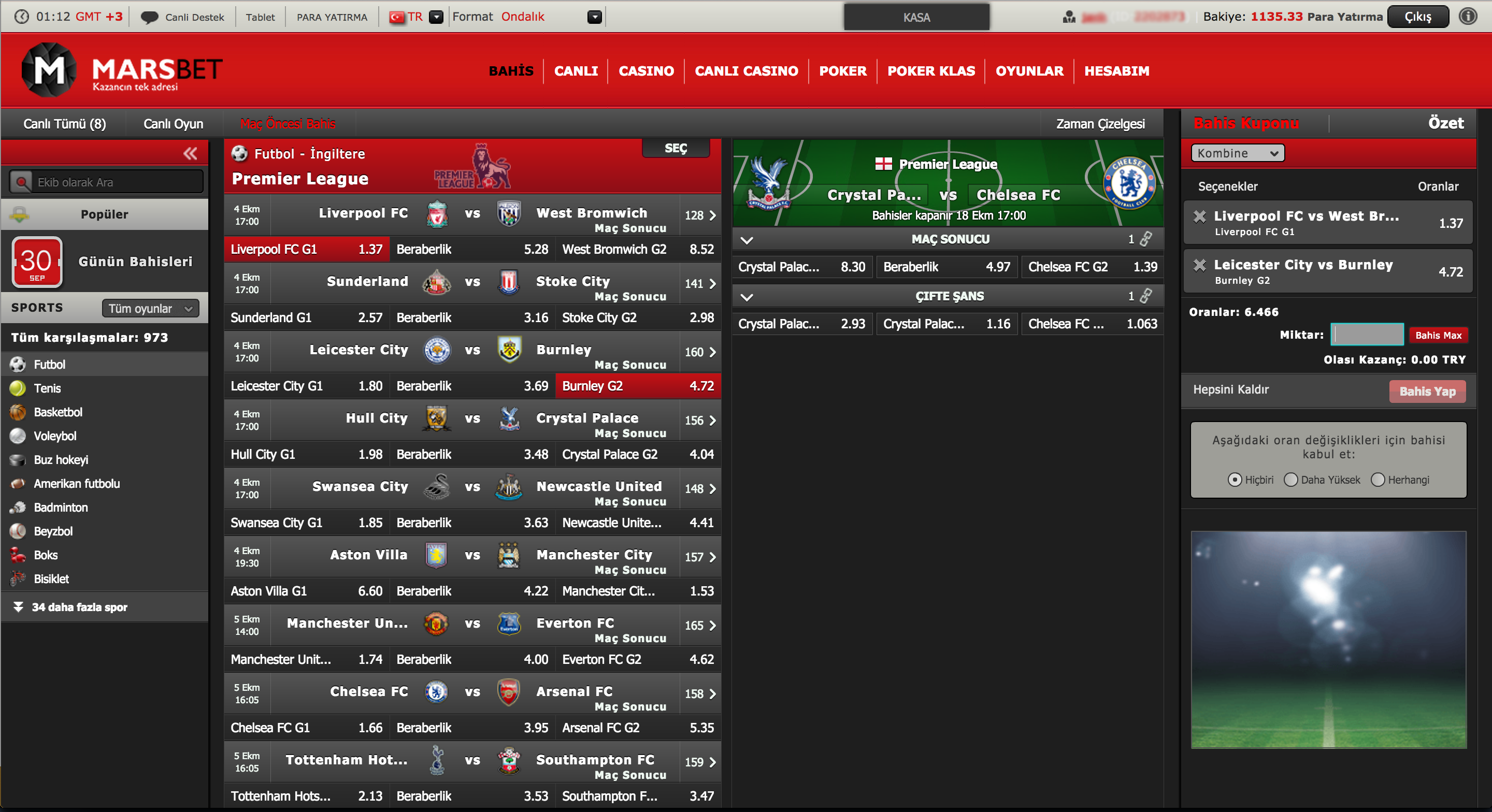

Marsbet 84 Marsbet'in yeni giriş adresi; İllegal Bahis Siteleri Bedava Bahis

I-90, Application to Replace Permanent Resident Card (Green Card) ALERT: On Jan. 30, 2024, USCIS announced a final rule, published in the Federal Register, that adjusts the fees required for most immigration applications and petitions. The new fees will be effective April 1, 2024. Applications and petitions postmarked on or after April 1, 2024.

💥Kavbet Özel💥 ⏱Sınırlı sayıda! 📌Gizli üyelikler bahis alamaz https//t.co/BY7sLOtAXo DÜNYANIN EN

Information Guide — Motor Fuels Tax Refunds Form 84, Nebraska Non-Ag Use Motor Fuels Tax Refund Claim Form 84AG, Nebraska Non-Ag Use Motor Fuels Tax Refund Claim Refund Rate Table (01/2024) Backup for refunds may be emailed to [email protected]. If you choose to email your backup, please add a note on your claim form to indicate that the backup was sent via email.

Lider Form'un 6'lı Ganyan ve Bahis Şovu devam ediyor... At Yarışı Haberleri

Information about Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, including recent updates, related forms, and instructions on how to file. Form W-9 is used to provide a correct TIN to payers (or brokers) required to file information returns with IRS.

Form Bilgisi TRENG Terimler PDF

E-8 Form (Fillable) Form E-8 is a notice to request an extension of time to file a business return. The business taxpayer is approved for a six-month extension of time when no tax delinquency exists. An extension of time to file your return does not grant you any extension of time to pay your tax liability. Publication Date: 02/23/2016.

Promosyonlar Golegol Bahis, Bet, Canlı Bahis, Canlı Casino En güvenilir bahis sitesi

Page Last Reviewed or Updated: 24-Jan-2024. Information about Form W-4, Employee's Withholding Certificate, including recent updates, related forms and instructions on how to file. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee's pay.

Deneme Bonusu Veren Bahis Siteleri Yeni Deneme Bonusu ( Betwoon ) YouTube

Unemployment Exclusion Update for married taxpayers living in a community property state -- 24-MAY-2021. Form 1040, 1040-SR, or 1040-NR, line 3a, Qualified dividends -- 06-APR-2021. Face masks and other personal protective equipment to prevent the spread of COVID-19 are tax deductible. New Exclusion of up to $10,200 of Unemployment Compensation.

2022 ADALET BAKANLIĞI 12 BİN 823 PERSONEL ALIM KILAVUZU YAYINLANDI NEREYE KAÇ ATAMA FORM BİLGİSİ

A refund is claimed by filing a Nebraska Non-Ag Use Motor Fuels Tax Refund Claim, Form 84, or a Nebraska Ag Use Motor Fuels Tax Refund Claim, Form 84AG. The claims must be filed within three. paid on a Form 2, Form 3, or Form 10, the refund will be reduced by the amount of use tax determined to be due. Diesel fuel used in processing.

Kayıpsız kazanç sistemi “22 kasım salı iddaa maç tahminleri” “iddaa” “iddaa tahminleri” Canlı

The EquiTrust Agent Gateway website has tools to help you. Under the Compliance and Suitability tab, you will find the "DOL Fiduciary Rule" drop-down menu. Within this menu, you will find the PTE 84-24 Disclosure form, training materials, and links to other useful information. Starting 2/1/22, the 84-24 Disclosure form is required to be.

Bahis Siteleri Para İşlemleri

A W-4 form, formally titled "Employee's Withholding Certificate," is an IRS tax document that employees fill out and submit to their employers. Employers use the information provided on a W-4 to.

Canlı Bahis panosundaki Pin

The IRS issued a new Form W-4 in 2020. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. And, although employees don't have to give employers an updated Form W-4 they should be encouraged to update their Form W-4. Each employee is responsible for their own withholding.

CEMOTİPS on Twitter "DÜN / YESTERDAY 1.77 ️ 1.60 ️ 1 47 ️ 1.50 ️ 1.75 ️ 1.84😔 1.42 ️ 1.96 ️ 1.

forms.app'de alacağınız tek şey ücretsiz kişisel form şablonları olmayacak. Formunuzun içeriği ve görünümü ile ilgili gelişmiş özelleştirme seçeneklerine sahip olacaksınız. E-posta adresi ve telefon numarası gibi temel bilgiler için sorular çoğu kişisel form şablonunda yer alırken, birkaç tıklamayla farklı sorular.

İDDAA BAHİS! 4 HAZİRAN 2023 PAZAR İDDAA TAHMİNLERİ GARANTİ KUPON YouTube

Form 1040 U.S. Individual Income Tax Return 2023 Department of the Treasury—Internal Revenue Service . OMB No. 1545-0074. IRS Use Only—Do not write or staple in this space. For the year Jan. 1-Dec. 31, 2023, or other tax year beginning , 2023, ending , 20 . See separate instructions. Your first name and middle initial . Last name

Cratosslot Canlı Bahis Sitesi Cratosslot Giriş Yap

Average Monthly Balance of ₹ 10,000/-; Avail upto 50 Free Transactions Across NEFT, RTGS & IMPS per month. Deposit Cash Anytime, anywhere at Fincare ATM. 12 Free Transactions per month Across all ATM

Lider Form'un 6'lı Ganyan ve Bahis Şovu devam ediyor... At Yarışı Haberleri

Appropriate documentation must be attached to the Form 84. Documentation submitted with the Form 84 will not be returned. Exempt Use of Tax-Paid Undyed Diesel, Gasoline, Gasohol, and Ethanol. Any person who has purchased and used tax-paid motor fuel for a qualified exempt purpose may file a claim. Required documentation.

Sanal Oyunlar Forvetbet güncel giriş adresi

Form W-4 Department of the Treasury Internal Revenue Service Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. OMB No. 1545-0074. 2024. Step 1: Enter Personal Information (a)