21D DDOI Gamma Exposure for AMEXSPY by SPYvsGME — TradingView

Gamma correction is sometimes specified in terms of the encoding gamma that it aims to compensate for — not the actual gamma that is applied. For example, the actual gamma applied with a "gamma correction of 1.5" is often equal to 1/1.5, since a gamma of 1/1.5 cancels a gamma of 1.5 (1.5 * 1/1.5 = 1.0). A higher gamma correction value might.

Gamma in Options Explained What is Gamma in Options?

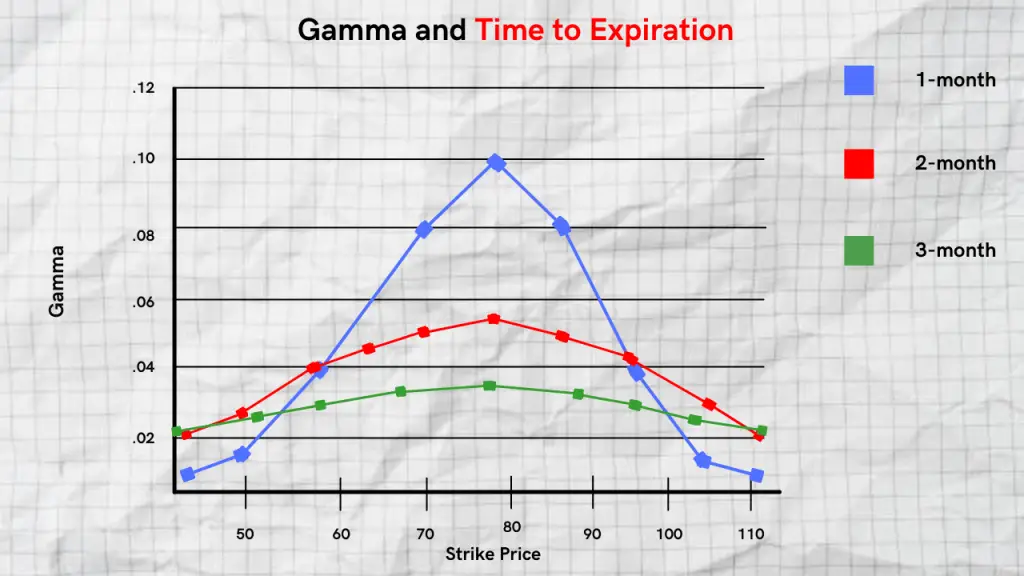

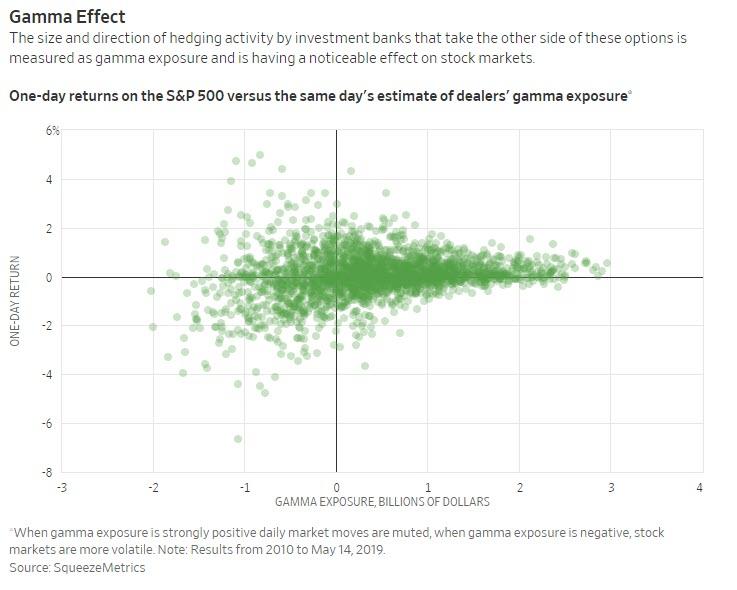

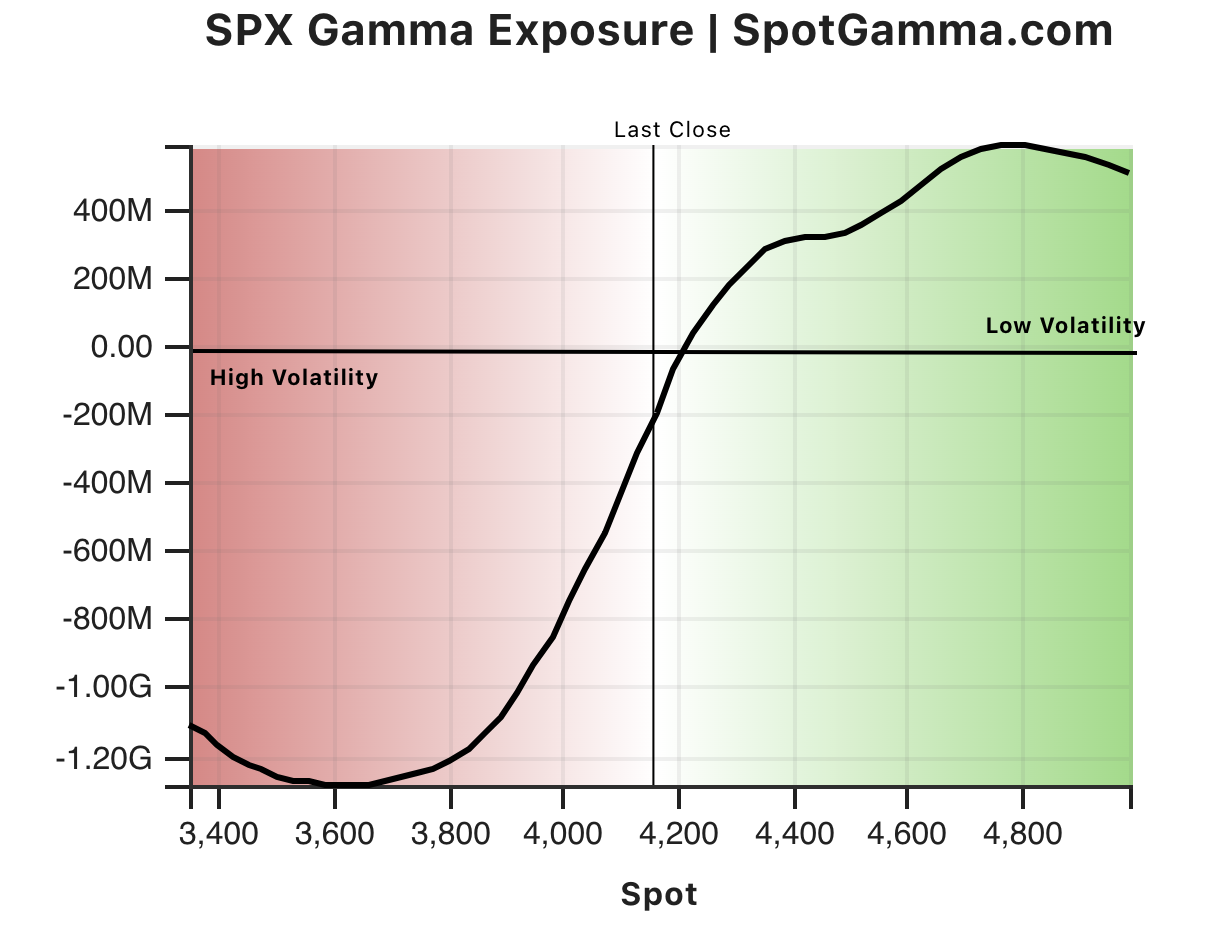

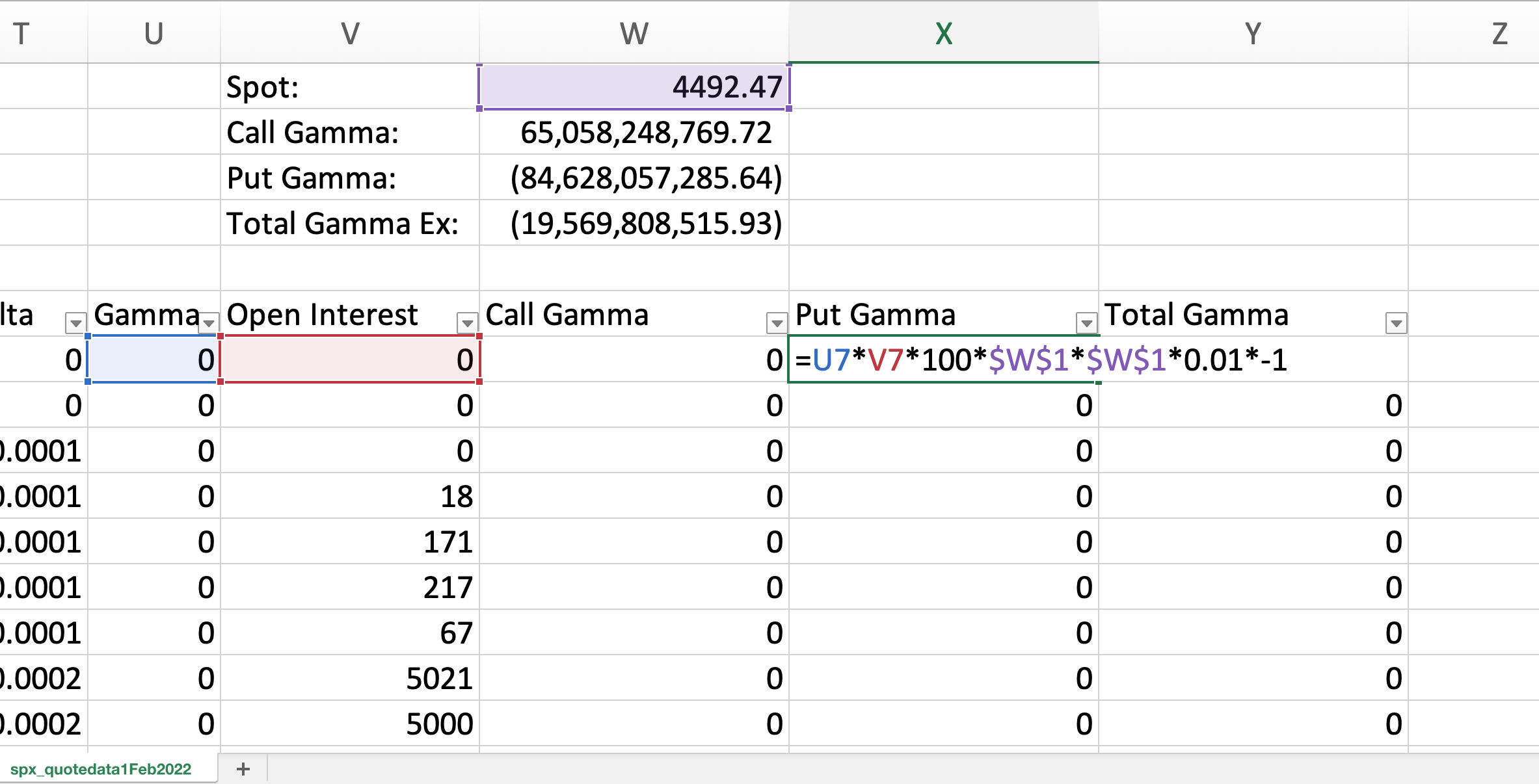

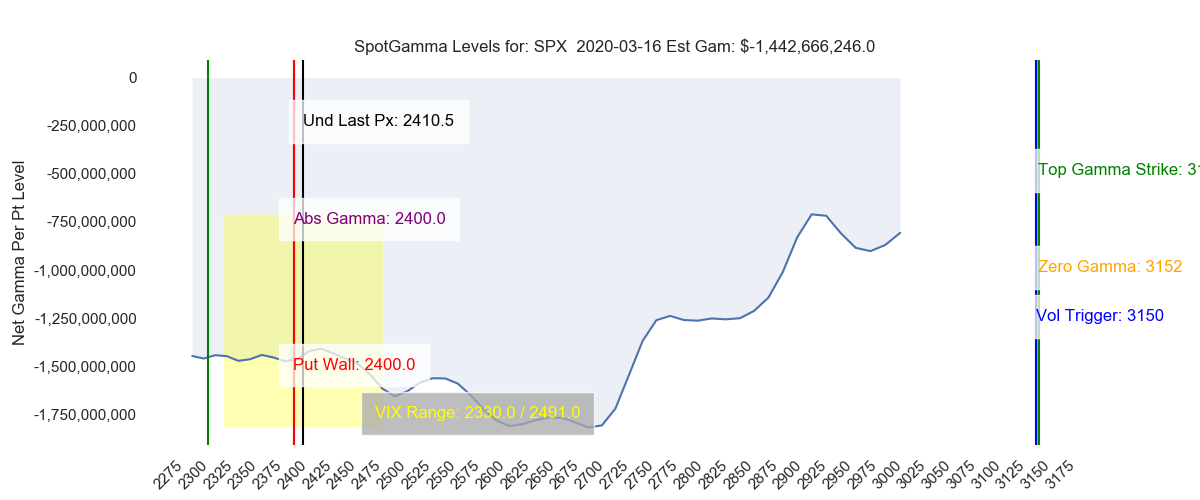

For the puts we multiply each by -1 as their gamma is negative. When we have them all calculated we add all the gamma with similar strikes together which would be the Total Gamma Exposure (GEX) for each strike. If you plot it it should look something like this. Total Gamma Exposure (GEX) vs. Strike Price

Why Gamma SpotGamma™

Gamma Exposure (GEX) is a valuable tool for analyzing supply and demand in the options market. In this video, we'll review how gamma works and how we formula.

Option Expiration, Gamma Exposure and all the rest systematic

Quick Answer: Gamma is a measure of the contrast between light and dark areas in an image. It is used to adjust the brightness, contrast, and color balance of digital images. What Is Gamma In Photography? Gamma in photography refers to the relationship between input and output values of an image.

Free Gamma Exposure Chart SpotGamma™

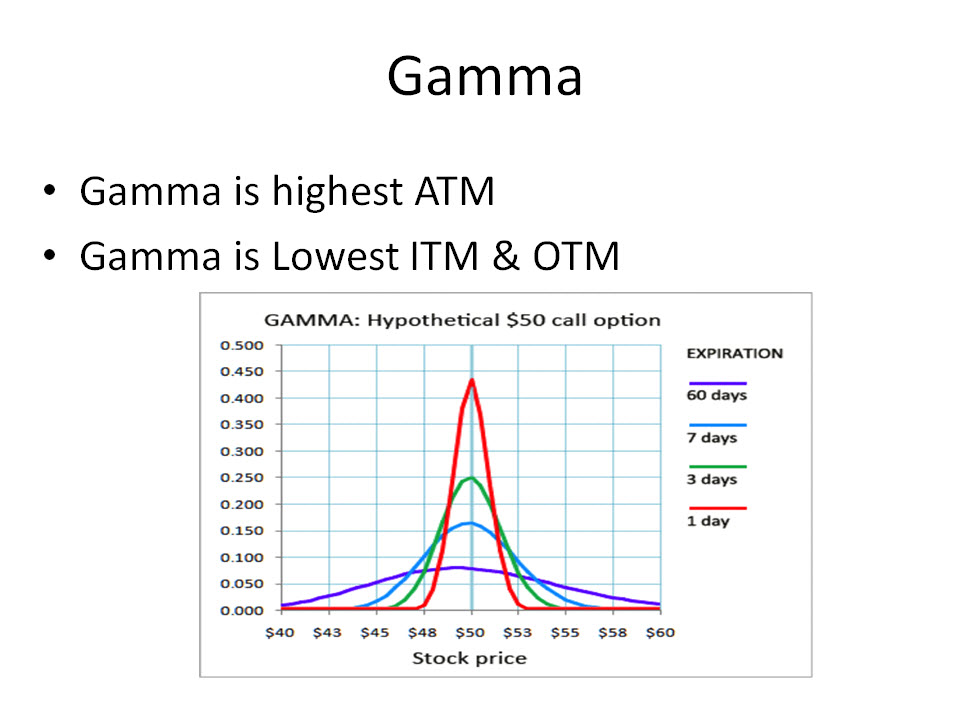

Gamma exposure, also known as dollar gamma, is a measure of the second-order price sensitivity of an option or portfolio to changes in the price of an underlying security. In mathematical terms, gamma exposure equals half the gamma of the portfolio multiplied by the square of the price of the underlying security.

What is gamma in option trading and more gbp eur exchange rate yahoo

Gamma & Gamma Exposure are talked about a lot by retail traders these days. Everyone is actively trying to learn complexities of options, and leverage differ.

How to Calculate Gamma Exposure (GEX) and Zero Gamma Level Perfiliev

Gamma correction or gamma is a nonlinear operation used to encode and decode luminance or tristimulus values in video or still image systems. [1] Gamma correction is, in the simplest cases, defined by the following power-law expression:

What is gamma exposure? Baldwinsnowmobiling

Research, Options Education, Gamma and Gamma Exposure. Gamma and Gamma Exposure (GEX) are becoming increasingly important forces in today's market, and have the potential to become one of the most important non-fundamental flows in equity markets. As traders, we are always interested in developing and understanding new and persistent market.

Gamma in Options Explained What is Gamma in Options?

What is the difference between Exposure vs Brightness vs Gamma? When do you use them? What do they actually change?In this beginners tutorial I show you the.

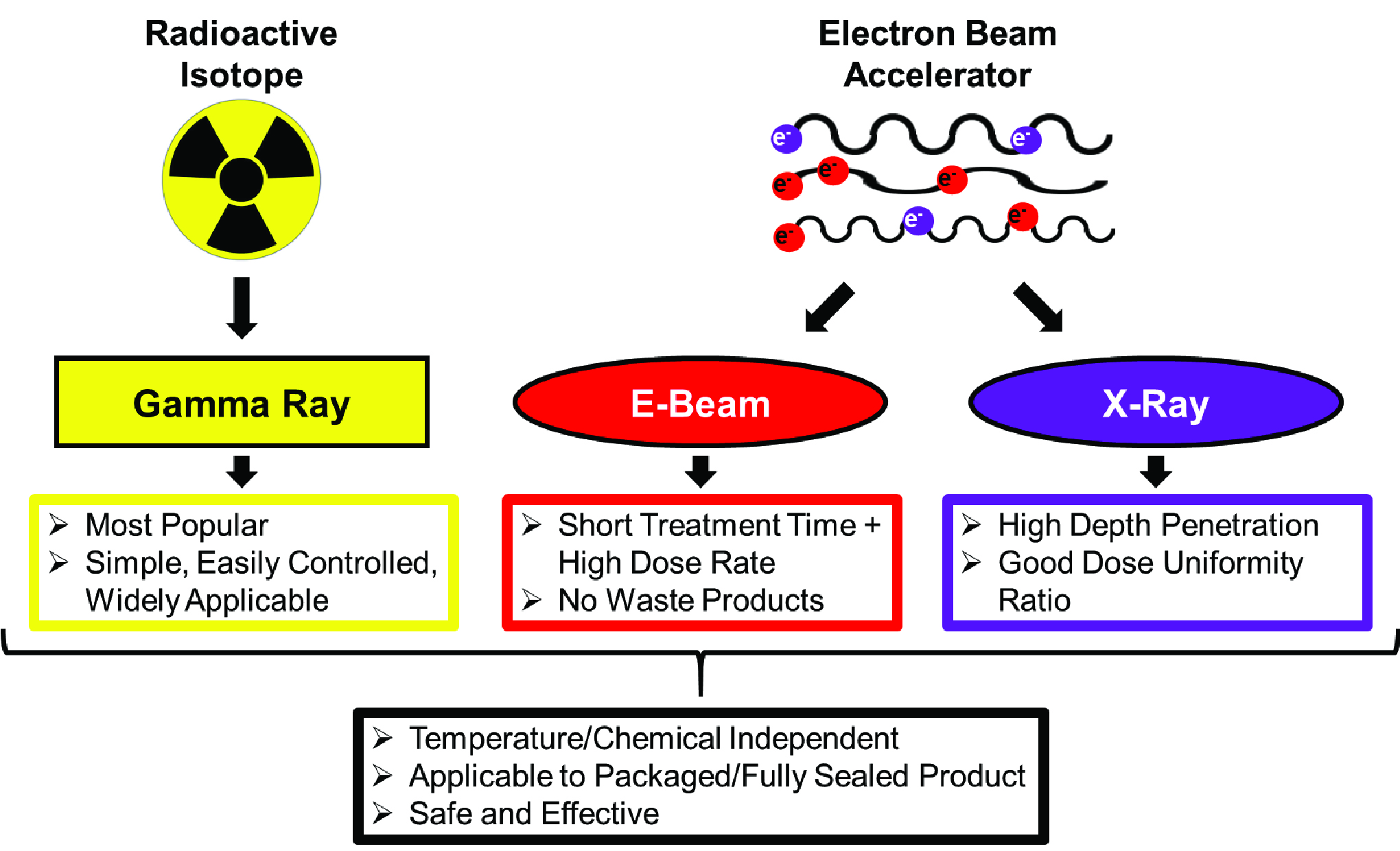

E Beam Sterilization Vs Gamma New Images Beam

Chris Frewin · Follow Published in Option Screener · 8 min read · Feb 6, 2023 1 Source: one of our Vanna exposure charts. Author's Note: While we do reference spot price gamma as well as spot.

How Far Do EMF Waves Travel?

Gamma will raise the brightness of the scene whilst retaining the relative intensities, which means that textures and materials are preserved. A quick example: Normal render - default gamma and exposure: 780×437 232 KB High exposure: 784×441 149 KB High gamma: 791×444 223 KB

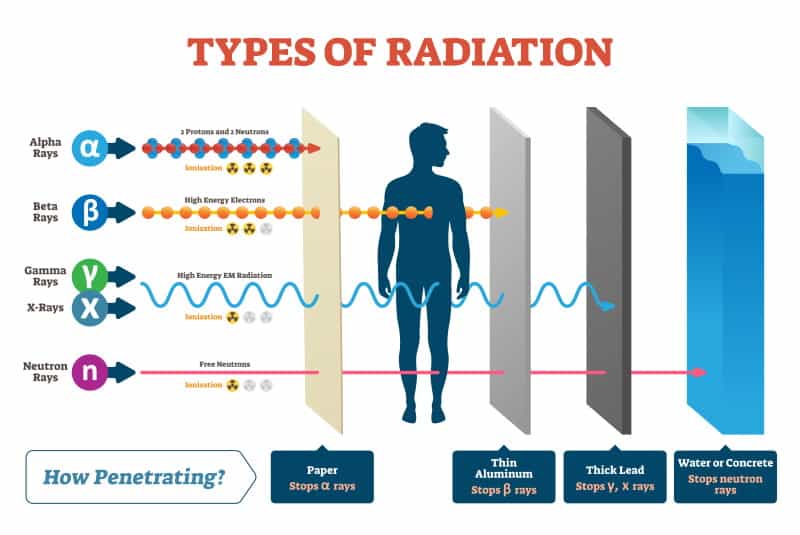

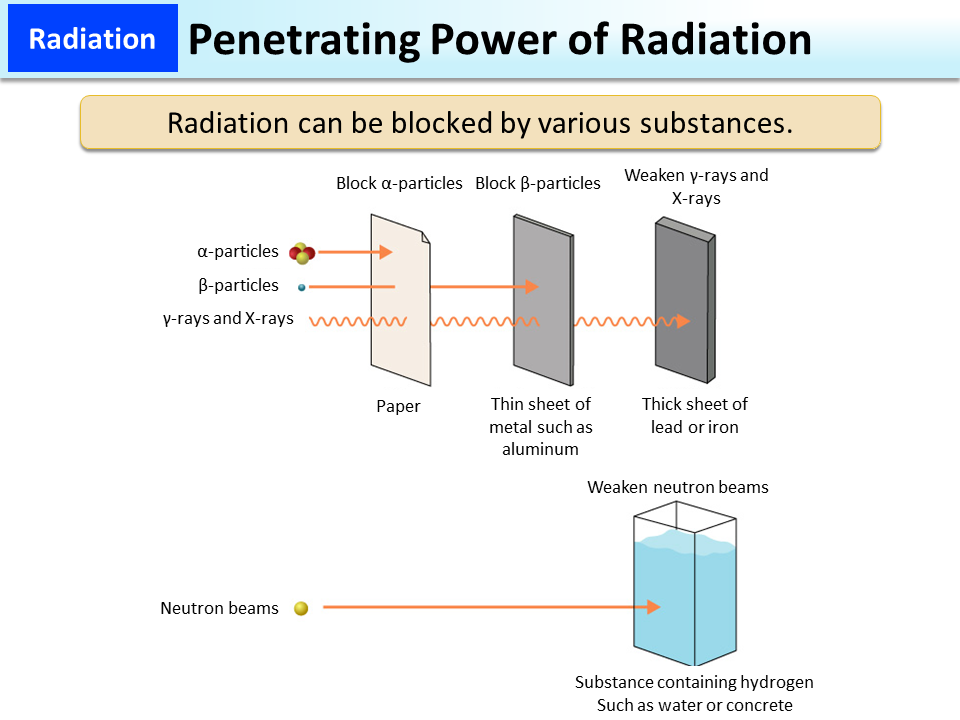

Power of Radiation [MOE]

Gamma Exposure. Gamma Exposure (GEX) and Gamma have become increasingly important. Due to these forces, traders must buy and sell to get reliable behavior. One of the hidden market forces is Gamma Exposure.. Gamma Exposure involves price sensitivity of derivatives to price changes in an underlying security. A huge factor in movements in the stock markets are when market makers are trading.

The Large 3/20 Options Expiration SpotGamma™

1) Every digital image has a dynamic range of gray levels.Now gray levels are nothing but values which ultimately corresponds to a color. Say Mono-chrome image (Black and white image) has only 2 gray levels i.e. 0 and 1 where 0 means black and 1 means white color. Here the dynamic range is [0-1].

Untitled Gamma

Displays and gamma HDR and tone reproduction.. F-Number and exposure: Fstops: 1.4 2 2.8 4.0 5.6 8 11 16 22 32 45 64 1 stop doubles exposure f = f a N a CS148 Lecture 12 Pat Hanrahan, Winter 2007 HET= Camera Exposure Exposure Exposure overdetermined Aperture: f-stop - 1 stop doubles H

Linear vs Gamma PBR workflows in Touch General TouchDesigner

Too dark because it simulates CRT losses showing an image with no gamma, because now your LCD also decodes gamma 1 to gamma 0.45, also too dark. This is the effect of CRT gamma losses. CRT is why we use gamma correction. Center slider at 1.0, normal default, normal gamma 2.2.

Option Expiration, Gamma Exposure and all the rest systematic

Gamma Exposure is a crucial concept within the world of options trading and derivatives. It helps traders understand the sensitivity of an option's price to changes in the underlying asset's value. Since options are derivatives, their behavior is intrinsically linked to the fluctuations of the underlying assets.