PPT Depreciation PowerPoint Presentation, free download ID9591902

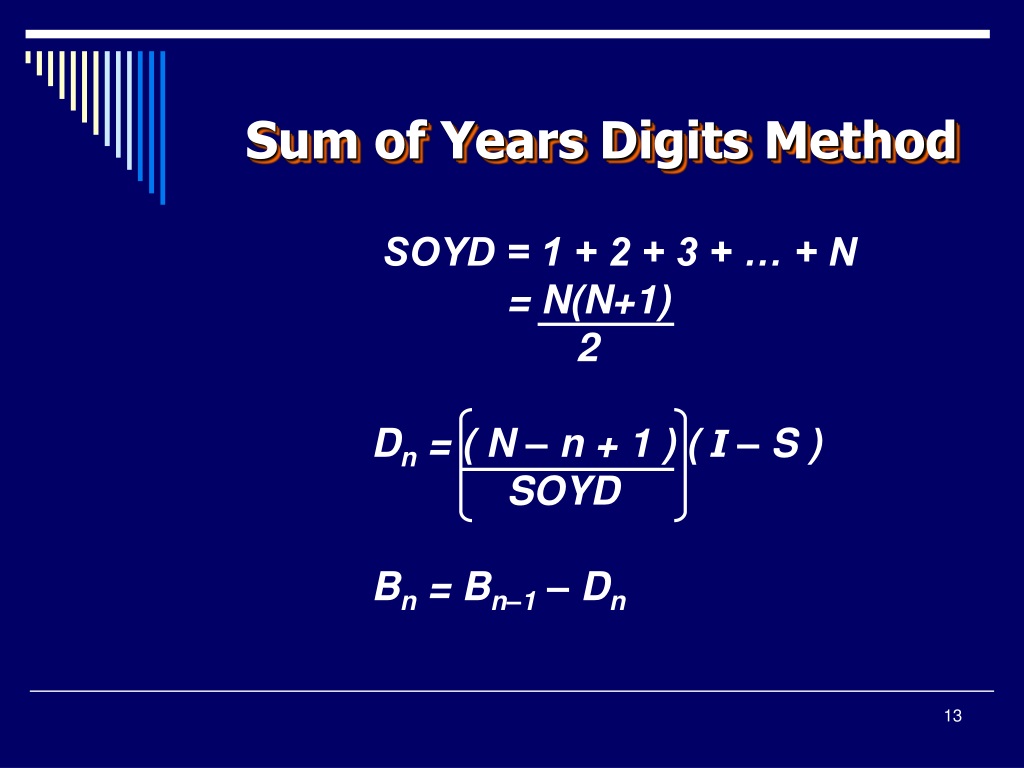

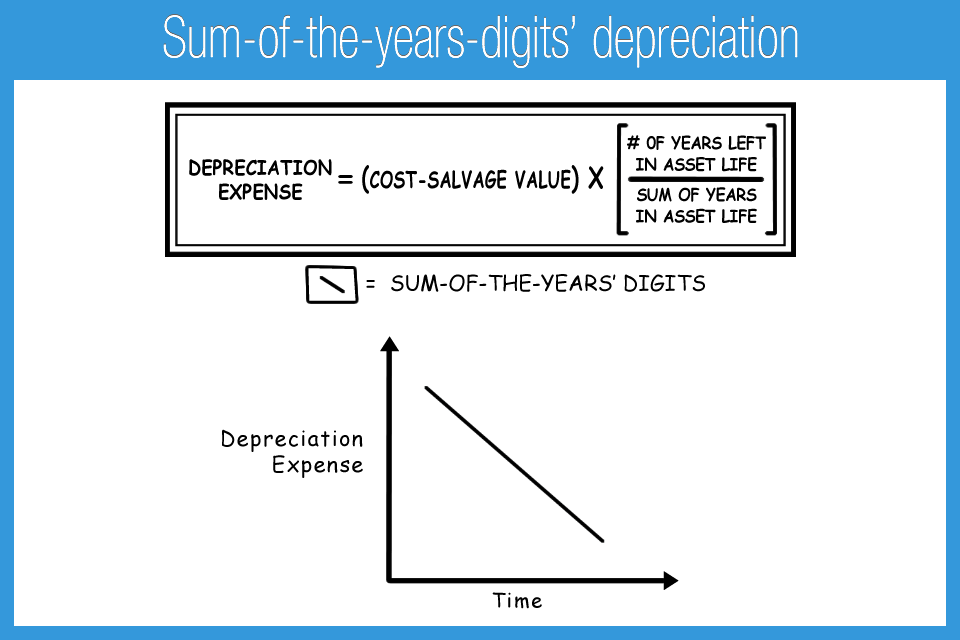

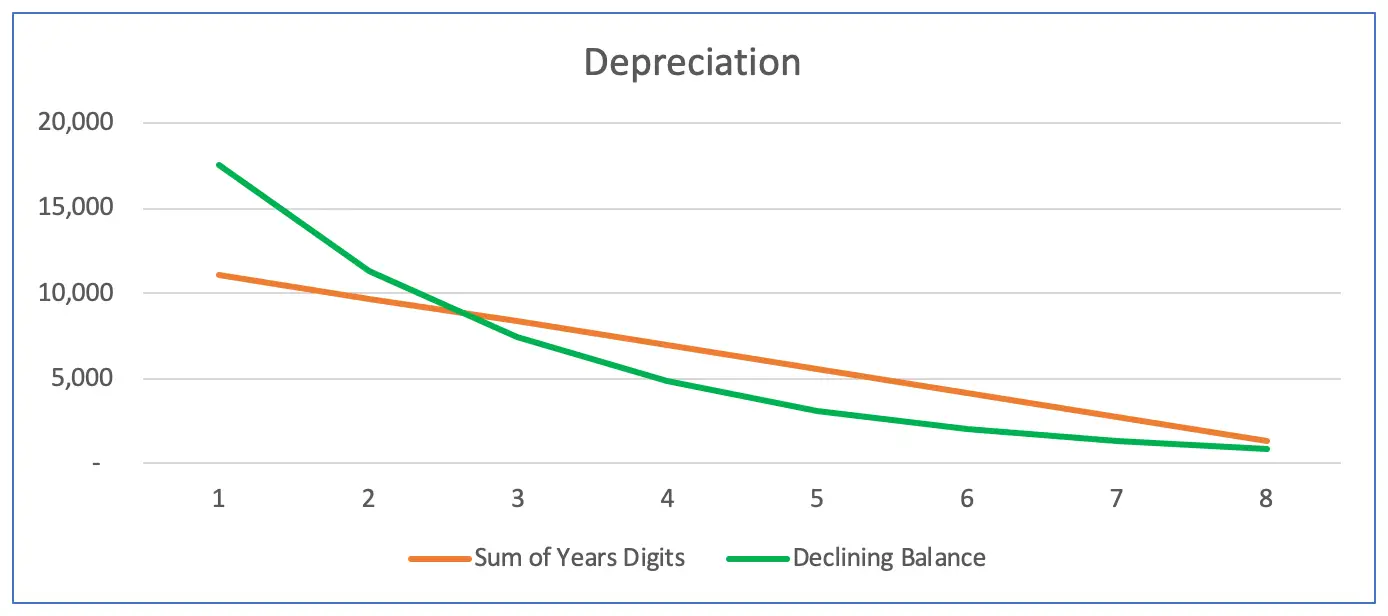

Sum-of-the-years' digits (SYD) is one of several methods employed to calculate depreciation. It's considered an accelerated depreciation method, meaning it assigns higher depreciation expenses to the early years of an asset's life. How to calculate SYD To calculate SYD, you follow a straightforward formula: SYD = (n - x + 1) * x / [n * (n + 1) / 2]

Sumoftheyearsdigits' depreciation Accounting Play

Sum of Years Digits Depreciation Calculator Calculator Use Use this calculator to calculate an accelerated depreciation using the sum of years digits method. Depreciation is taken as a fractional part of a sum of all the years. Create and print schedules. Inputs Asset Cost

Sum of the Years Digits YouTube

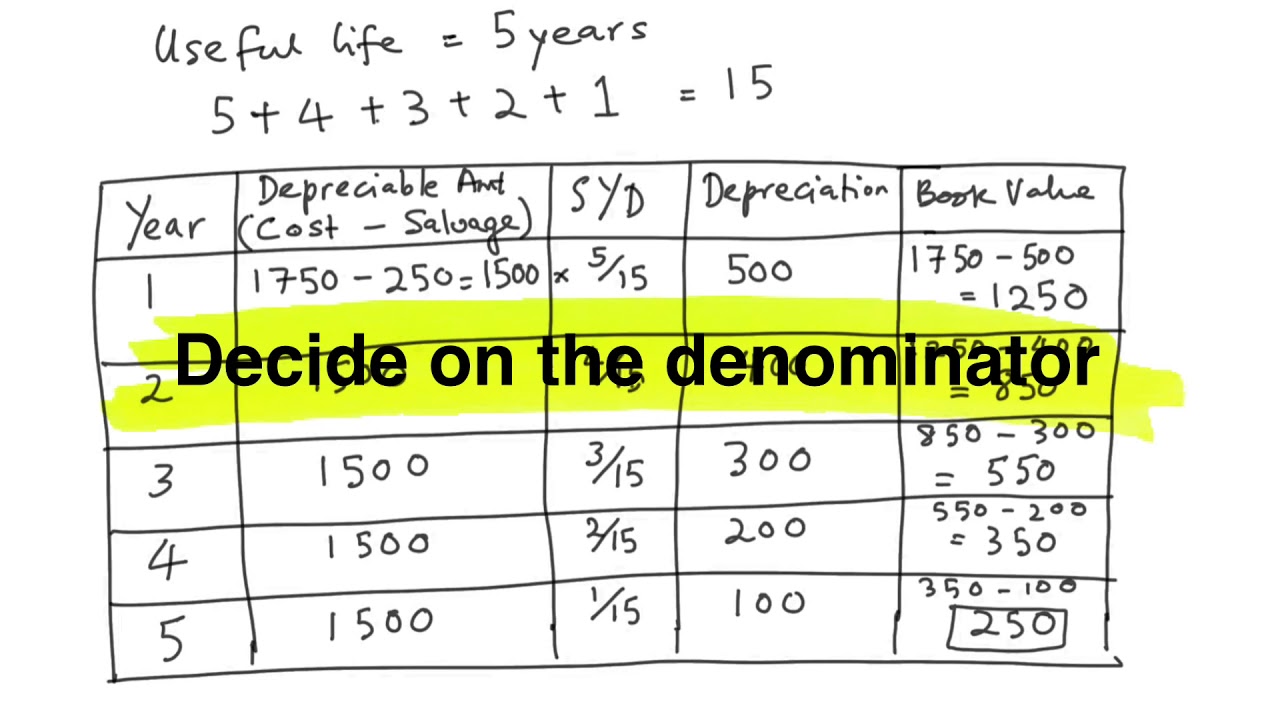

This video explains the sum-of-the-years'-digits depreciation method, and illustrates how to calculate depreciation expense using the sum-of-the-years'-digit.

:max_bytes(150000):strip_icc()/Sum-of-the-years-digits-4188390-primary-final-b5aa6b9fc28a4ba2b1f04d06672b9b20.png)

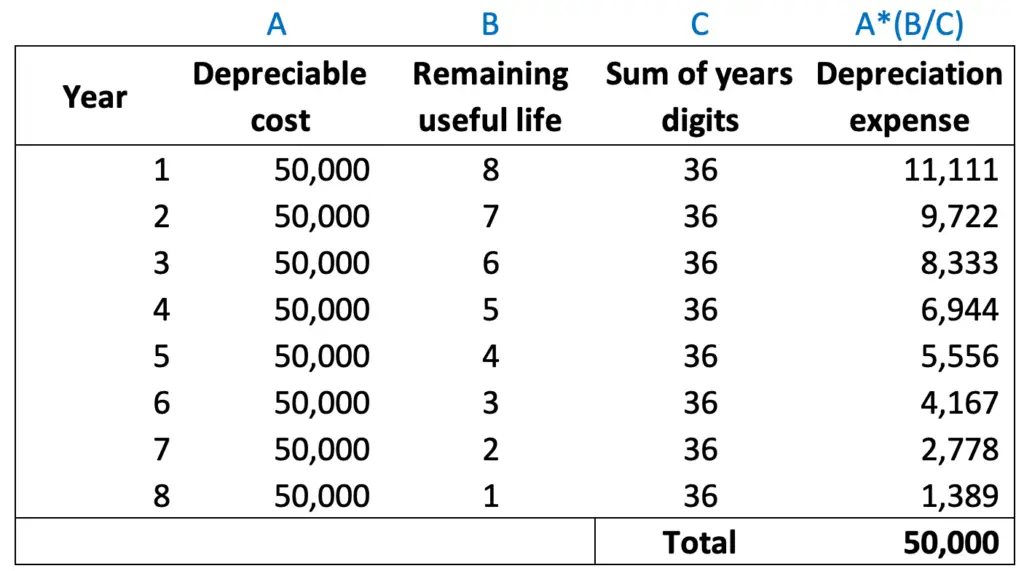

SumoftheYears' Digits Definition and How to Calculate

The sum of years digits (SYD) is simply the sum of the year numbers. So for example, if there are 3 years then the sum of years digits is equal to 1+2+3 = 6, if there are 8 years then the SYD is equal to 1+2+3+4+5+6+7+8 = 36. This process can be summarized in the sum of years digits formula as follows: Sum of the years digits = n x (n + 1) / 2.

Sum of the Years Digits Depreciation

Sum of the year digits' depreciation is the accelerated accumulated depreciation that counts the salvage value of assets among. Learn more at Accounting play.

Sum of Years' Digits Depreciation Accountingo

Low prices on millions of books. Free UK delivery on eligible orders. Browse new releases, best sellers or classics & find your next favourite book

How to Calculate Sum of the Years Digits Depreciation Accounting How To

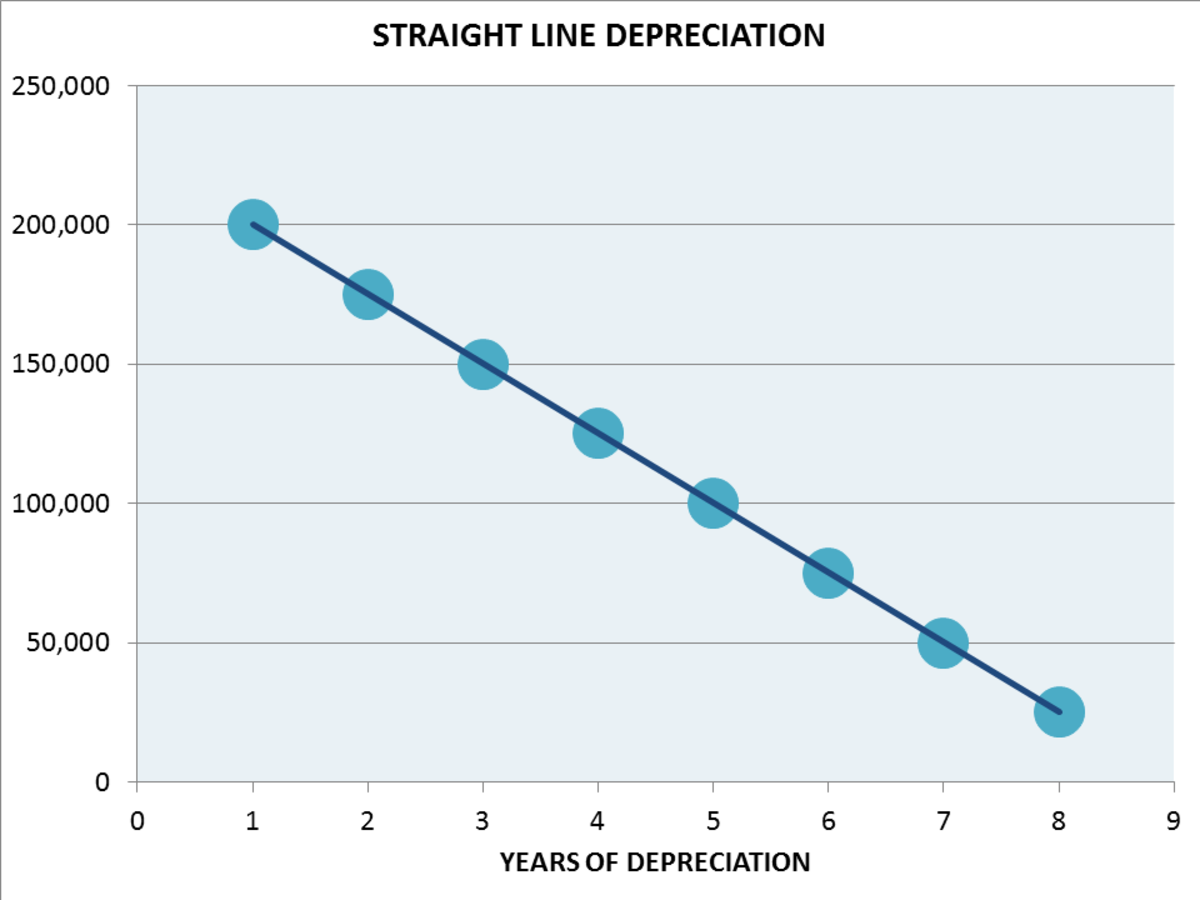

Sum of years Digits Methods or the sum of year depreciation method is an accelerated depreciation method whereby the method declines the asset's value at an accelerated rate. Most of the depreciation of an asset is recognized in the first few years of its useful life.

Sum of The Year’s Digits Depreciation Model Formula, Examples, Journal Entries

The sum of the years' digits depreciation method accelerates depreciation, to record more depreciation expense earlier in an asset's life.

Sum Of Years Digits Depreciation Concept, Formulas & Solved Problem PMP Exam YouTube

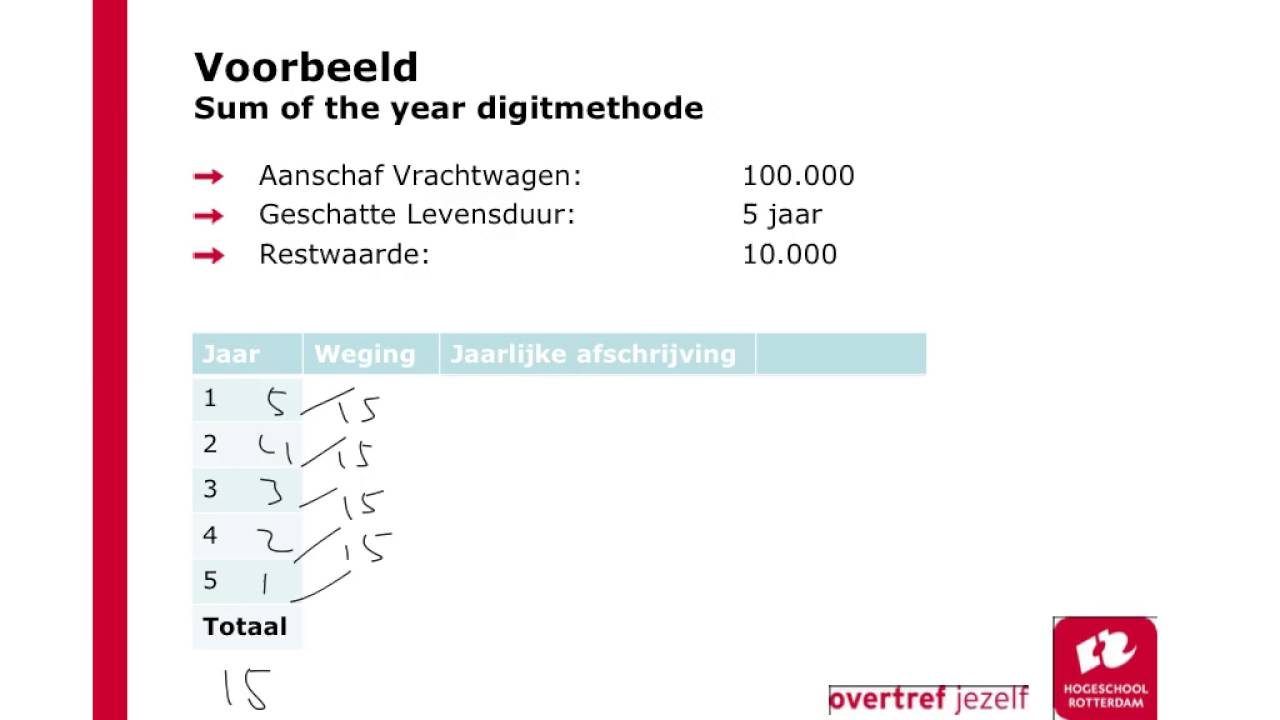

The sum of the years' digits depreciation calculation is: This formula yields the sum of each year of the estimated useful life: 1 + 2 + 3 + 4 + 5 = 15 The sum of the years' digits method is used to accelerate the recognition of depreciation into the first few years of an asset's useful life.

Calculate sum of the years digits depreciation Example Accountinguide

Learn how to depreciate using the sum-of-the-years'-digits method.To download this spreadsheet and follow along with the video, please click here: https://ww.

Unit 6 Sum of Year Digit Method for ACCT221 Spring 2020 YouTube

Sum-of-the-year digits Method This is a method that allocates higher depreciation expense in the initial years of asset use. It also falls under the category of accelerated depreciation methods. The method adds up the number of years across which the asset was utilized. We shall learn in-depth about it in the upcoming sections.

Sum of Years Digits Depreciation Method YouTube

Step 1: Denominator Take each of the years in the asset's useful life and add them together. For example, if an asset has a useful life of 10 years, the total is 55— 10 + 9 + 8 + 7 + 6 + 5+ 4 + 3 + 2 + 1. Hint: the formula N (N+1) / 2 is a quick way to calculate the sum of all numbers from 1 to N.

sumoftheyears'digits method partial year YouTube

If the above formula is used for an asset having a useful life of 10 years, the sum of the digits will be: 10 (10+1)/2 = 10 (11)/2 = 110/2 = 55. In the first year of an asset with a 10-year useful life, the depreciation will be 10/55 of the amount to be depreciated. The second year will use 9/55 and the tenth year will use 1/55.

18. depreciation formula for sumoftheyearsdigits YouTube

Sum-of-the-Years' Digits: Definition. Sum-of-the-years' digits is a method that uses an arbitrary arithmetic system to derive the annual depreciation charges. It is known as an accelerated depreciation method.. In this method, you multiply the depreciable basis amount by an annual fraction. The denominator is the sum of the digits from 1 to n, where n is the number of years in the asset's.

Calculate sum of the years digits depreciation Example Accountinguide

Step 5. Finally the sum of years depreciation calculator works out the depreciation expense for the period entered in step 4. In addition, the calculator provides a sum of the years digits depreciation schedule setting out for each period, the beginning asset book value, the depreciation expense for the period, and the ending asset book value.

B5 Sum of the year digit methode YouTube

Step 1: Calculate the sum of the years digits Sum of the years' digits = 3 + 2 + 1 = 6 Step 2: Calculate the depreciable amount Depreciable amount = $100,000 - $10,000 = $90,000 Step 3: Calculate the un-depreciated useful life Step 4: Calculate depreciation expense Year 1: Depreciation expense: Year 2: Depreciation expense: