What is a Debt Collector? YouTube

5 ways to deal with debt collectors. If you're dealing with a third-party debt collector, there are five steps you can take to handle the situation. 1. Be smart about how you communicate. Debt.

Debt Collector interviewTugboat YouTube

The FDCPA is federal law that applies to personal and household debts, like money owed for the purchase of a car, for medical care, student loans, and mortgages. It does not apply to debt owed for business purposes. ( 15 U.S.C. § 1692-1692p ). Third-party debt collectors are prohibited from engaging in unfair, deceptive, or abusive practices.

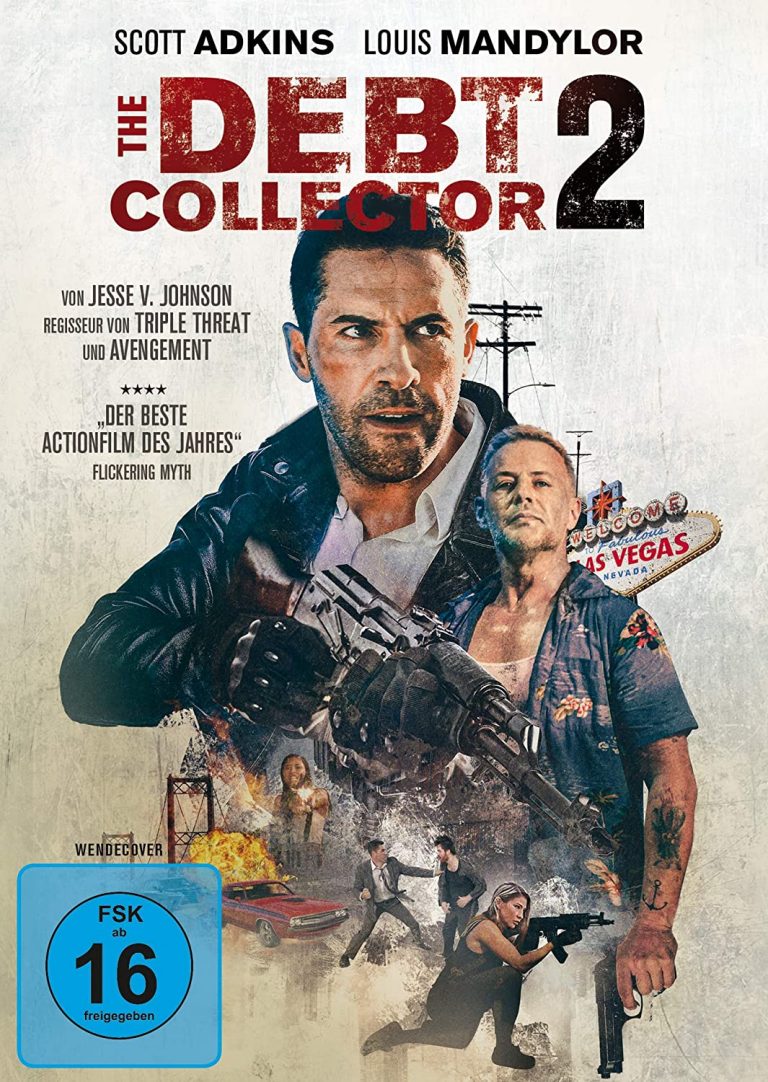

The Debt Collector 2 FilmRezensionen.de

A debt collector may be trying to contact you because: A creditor believes you are past due on a debt. Creditors may use their own in-house debt collectors or may refer or sell your debt to an outside debt collector. A debt collector also may be calling you to locate someone you know, but the collector is not allowed to reveal that the consumer.

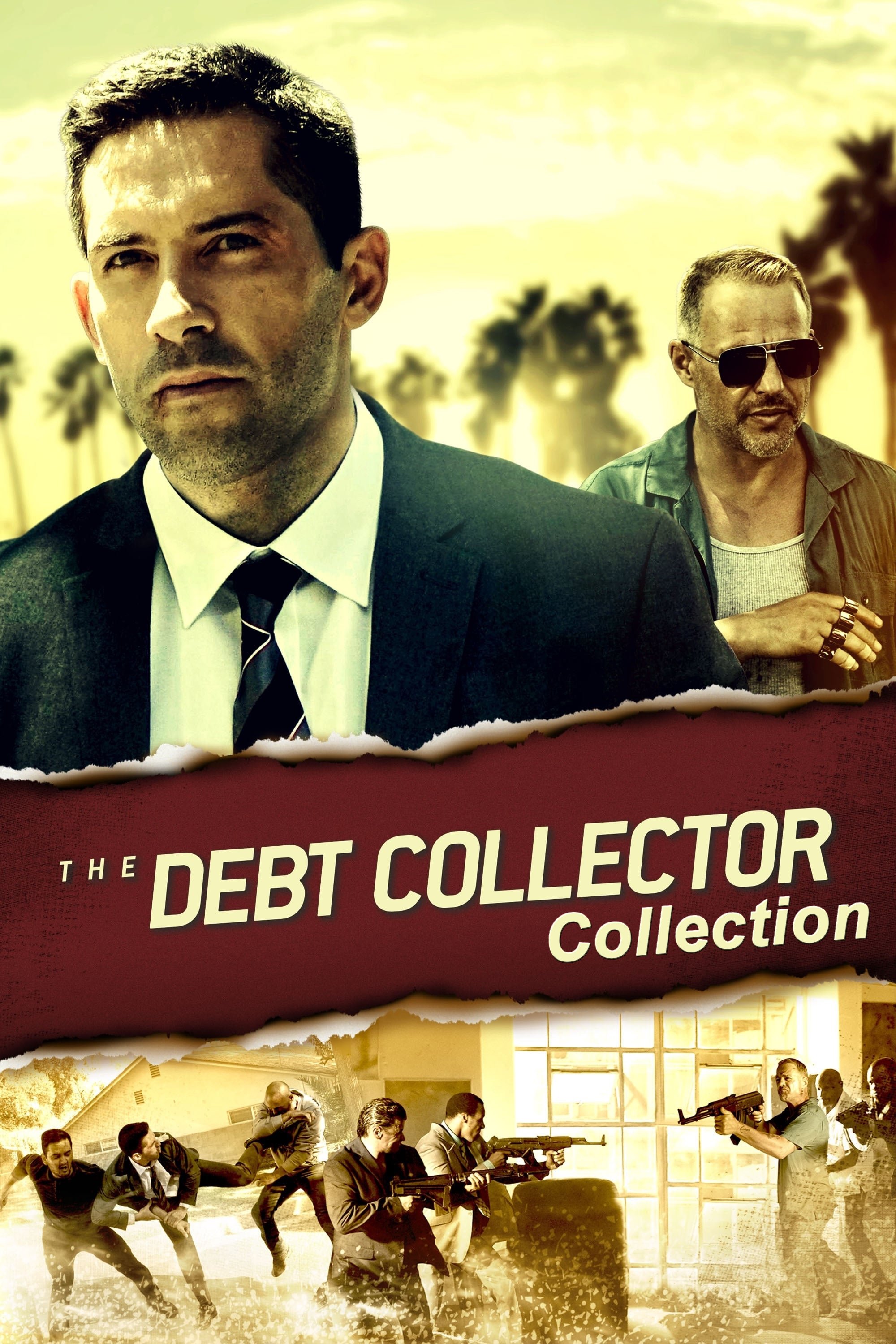

Image gallery for "The Debt Collector " FilmAffinity

The Consumer Financial Protection Bureau published its final Debt Collection Rule ("Rule") with an effective date of November 30, 2021. Published in two parts, the Rule addresses technological advancements since the FDCPA was enacted in 1977. Part 1 of the Rule expands on the provisions of the FDCPA, while attempting to clarify how debt.

Fight Back Against Debt Collector Harassment AZ Consumer Law Group

Understand how the CFPB's Debt Collection Rule can help you. On November 30, 2021, the Debt Collection Rule became effective. The rule clarifies how debt collectors can communicate with you, including what information they're required to provide you. Learn more about the new debt collection rule.

How to settle with a debt collector and make the best offer Resolve

This can be a helpful way to know more about the debt, as well as tell whether or not it's a scam. To verify a debt collector, ask them to provide: Their name. Company name. Company street address. Telephone number. Professional license number, if your state licenses debt collectors. To help you verify this information, you can find out more.

DEBT COLLECTOR SERIES (FULL EPISODE) YouTube

3 steps for dealing with a debt collector. 1. Don't give in to pressure to pay on first contact. Just as you wouldn't jump into a contract without understanding its terms, don't rush to make a.

Koleksiyon The Debt Collector Duology Collection Türkçe Ses Dosyası Paylaşım

2. Reach out to your state's attorney general. Your attorney general's office is on the alert for scammers and aims to put a halt to fraud such as debt collector scams. Most have a toll-free.

:max_bytes(150000):strip_icc()/GettyImages-172423517-56a2ba205f9b58b7d0cdcbff.jpg)

Can Debt Collectors Contact Your Employer?

Tucson: (520) 628-6648. Outside metro areas: (800) 352-8431. Bilingual consumer protection staff is available to assist. Debt collectors are individuals tasked with collecting money owed on personal loans, car leases or mortgages. Many collection agencies operate ethically and within the law, but others engage in illegal behavior in attempts to.

The Debt Collector Movie Review YouTube

3. Regulation F could require creditors to be more involved in third-party collections. 4. Regulation F may require creditors and debt collectors to make judgment calls. 5. Regulation F is more complex than it may appear. 6. Reviewing state law should be a step in the Regulation F implementation process.

The Debt Collector // Bleiberg Ent on Behance Debt collector, Debt, The collector

Arizona law requires most collection agencies and debt collectors to be licensed and bonded (for exceptions, see 32-1004) and to follow certain rules. The law aims to ensure that debt collectors' practices are transparent and fair. This means that debt collectors can't engage in unfair or misleading practices, including misrepresenting who.

Jangan Takut dengan DEBT COLLECTOR!

Debt Collection FAQs. Administrative Office of the U.S. Courts - Bankruptcy Basics. If you want to find an attorney, you may contact the State Bar of Arizona. If you are in Maricopa and Pima Counties, the local Bar Associations offer lawyer referral services and will direct you to a lawyer for a small consultation fee. For more information call.

The Debt Collector YouTube

Responding to a debt collector's lawsuit will likely put you in a better position, cost you less in fees, and give you more control over how you repay the debt. So, if you get sued by a debt collector: Answer the lawsuit, which you may have to do in writing or by showing up to court — or both. The legal papers you got will tell you what to.

The Debt Collector? YouTube

If you think a debt collector failed to give you this information, you can submit a complaint with the CFPB. Disputing a debt. Once you receive the debt validation information, you have 30 days to dispute the debt in writing. Failing to request verification in writing or within this time period can affect your ability to assert your rights.

Debt Collectors Calling About a Debt You Don't Owe? You're Not Alone

Say you don't owe some or all of the money, and ask for verification of the debt. Make sure to send the dispute letter within 30 days. Once the collection company gets the letter, it must stop trying to collect the debt until it sends you written verification of the debt, like a copy of the original bill for the amount you owe.

How to Recognize Debt Collector Scams YouTube

Arizona law defines a "collection agency" as someone who is "engaged" in collecting debts, including anyone who collects debts occurring in the operation of the person's own business but collects payments from customers under a different name. (Ariz. Rev. Stat. § 32-1001). Some parties are exempt from certain parts of the law, like attorneys.